Category: income

Kentucky USDA Rural Housing County Income Limits for 2022

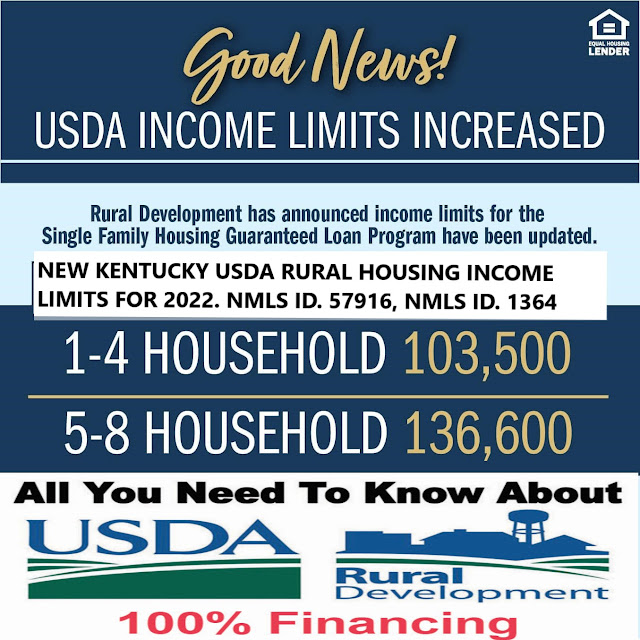

The base USDA income limits are for most Kentucky counties below:

New Income limits for most counties (*) in Kentucky are $103,500 for a household family of four and household families of five or more can make up to $136,600 with the new changes for

2022 Kentucky USDA Income limits, the Jefferson County Louisville, KY Metro area (**) saw an increase of $103,500 for a family of four and up to $136,600 for a family of five or more. The metro area surrounding counties of Jefferson County includes Oldham, Bullitt, Spencer are included in these higher income limits for USDA loans.

Remember, the entire Jefferson County and Fayette County Kentucky counties are not eligible for USDA loans. Along with parts of the following counties Daviess (Owensboro), Mccracken (Paducah), Madison County, (Richmond), Clark County (Winchester), Warren (Bowling Green), Hardin (Fort Knox and Radcliff), Bullitt(Hillview, Maryville, Zoneton, Fairdale, Brooks), Franklin, (Frankfort), Henderson (Henderson City Limits), Christian County (Hopkinsville, Fort Campbell), Boyd County (Ashland city limits) and the most Northern Parts of Boone, Kenton, Campbell Counties of Northern Kentucky (Covington, Florence, Richwood, Hebron, Ludlow, Fort Thomas, Bellevue, Ryle, Beechwood, )

The Northern Kentucky Counties (***) of Boon, Kenton, Campbell, Bracken, Gallatin, and Pendleton are $109,850 for a household of four or less and up to $145,000 for a family of five or more.

USDA Eligible Areas in Northern Kentucky

Burlington

Hebron

Independence

Walton

Alexandria

Highland Heights

Cold Springs

Grant County

Owen County

Pendleton County

USDA Income Limits

Boone, Kenton & Campbell Counties (N. KY)

$109,850 (family size 1-4)

$145,000 (family size 5 or more)

Grant, Owen & Pendleton Counties (N. KY)

$103,500 (family size 1-4)

$136,600 (family size 5 or more)

Most are familiar with USDA Rural Housing Loan Program being a great no money down program available and it is not just for Kentucky first time buyers.

You must be logged in to post a comment.