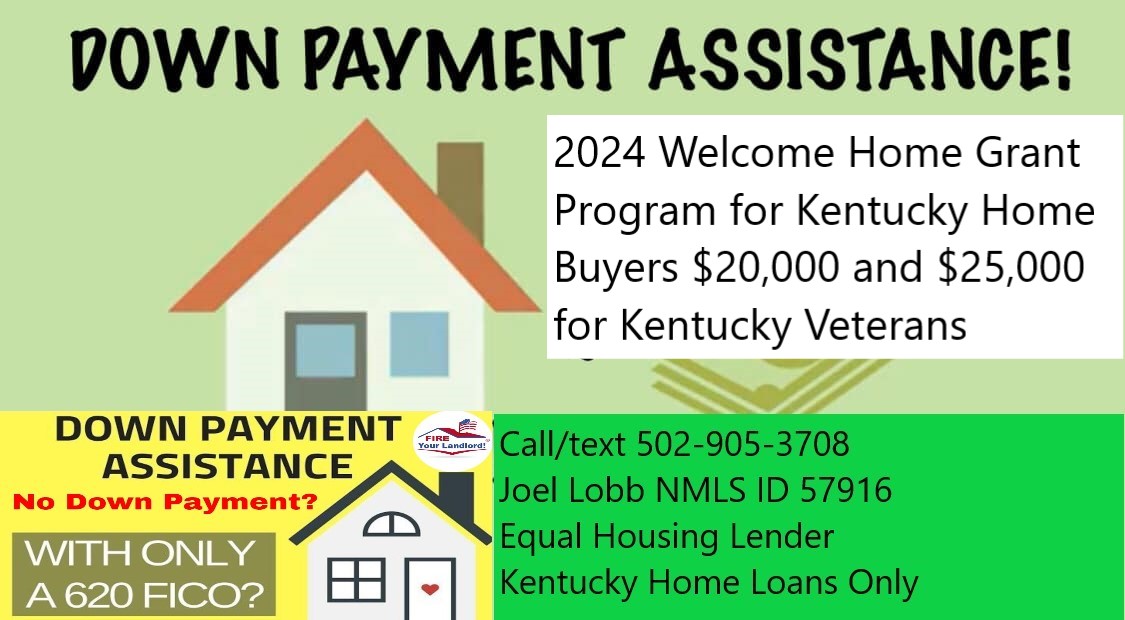

Information for Kentucky Homebuyers

Welcome Home Program Grant Program for Kentucky Home buyers in 2024

Who are Eligible Homebuyers in Kentucky for the Welcome Grant?

A fully executed (signed by buyer and seller) purchase contract on an eligible property is in hand;

The homebuyer has at least $500 of their own funds to contribute towards down payment and/or closing costs; and,

If a first-time homebuyer (typically anyone who has not owned a home in the last three years), a satisfactory homebuyer counseling course is completed prior to the loan closing. Note: Applicants do not have to be first-time homebuyers.

What is an Eligible Property?

The property is a single family, townhome, condominium, duplex, multi-unit (up to four family units) or a qualified manufactured home. (Manufactured homes may be eligible if they are taxed as real estate and affixed to a permanent foundation); and,

The property is subject to a legally enforceable five-year retention mechanism, included in the Deed or as a Declaration of Restrictive Covenants to the Deed, requiring the FHLB Cincinnati be given notice of any refinancing, sale, foreclosure, deed in-lieu of foreclosure, or change in ownership during the five year retention period.

How Do I Apply?

- HUD Community Development Block Grants (CDBG) — Kentucky contacts: HUD provides grant money to communities and those funds may be used to assist home buyers

- HUD HOME Program — Kentucky contacts: HUD provides grant money to communities designated as participating jurisdictions for assisting home buyers, rental assistance, and other housing initiatives

- Community Ventures Corporation Kentucky Home Financing

- The Kentucky Housing Corporation offers:

- Habitat for Humanity: Through volunteer labor and donations of money and materials, Habitat builds and rehabilitates simple, decent houses with the help of the homeowner (partner) families

- Federal Home Loan Bank of Cincinnati: Serves Kentucky residents by offering various home buying assistance programs, including Welcome Home grants. For more information, you may call 1 (888) 345-2246

- Kentucky Area Development Districts (ADDs): Contact your local ADD to find out more about local home buying assistance programs

- Kentucky Association for Community Action: Helps to fund housing programs for low-income residents

- Federal Appalachian Housing Enterprise (FAHE): Provides housing assistance in rural, low-income, Appalachian communities

- Housing Partnership, Inc.: Provides affordable housing services for residents of Jefferson County

- Secondary financing/down payment assistance programs are listed by state

- USDA Rural Development: Home buying loan programs that reduce the cost of homeownership for low and moderate-income families

| 100% limits | 80% limits**** Use this | |||||

| 1-2 Persons | 3 + Persons | 1-2 Persons | 3 + Persons | |||

| Adair | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 | ||

| Allen | $ 78,600 | $ 91,420 | $ 62,880 | $ 73,136 | ||

| Anderson | $ 86,270 | $ 99,210 | $ 69,016 | $ 79,368 | ||

| Ballard | $ 80,400 | $ 93,800 | $ 64,320 | $ 75,040 | ||

| Barren | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 | ||

| Bath | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Bell | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Boone | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 | ||

| Bourbon | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 | ||

| Boyd | $ 83,040 | $ 96,880 | $ 66,432 | $ 77,504 | ||

| Boyle | $ 80,760 | $ 94,220 | $ 64,608 | $ 75,376 | ||

| Bracken | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 | ||

| Breathitt | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Breckinridge | $ 87,410 | $ 100,521 | $ 69,928 | $ 80,417 | ||

| Bullitt | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 | ||

| Butler | $ 78,600 | $ 91,420 | $ 62,880 | $ 73,136 | ||

| Caldwell | $ 84,480 | $ 98,560 | $ 67,584 | $ 78,848 | ||

| Calloway | $ 82,560 | $ 96,320 | $ 66,048 | $ 77,056 | ||

| Campbell | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 | ||

| Carlisle | $ 78,600 | $ 90,860 | $ 62,880 | $ 72,688 | ||

| Carroll | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 | ||

| Carter | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Casey | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Christian | $ 87,590 | $ 100,728 | $ 70,072 | $ 80,582 | ||

| Clark | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 | ||

| Clay | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Clinton | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| Crittenden | $ 83,760 | $ 97,720 | $ 67,008 | $ 78,176 | ||

| Cumberland | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 | ||

| Daviess | $ 86,950 | $ 99,992 | $ 69,560 | $ 79,994 | ||

| Edmonson | $ 86,650 | $ 99,647 | $ 69,320 | $ 79,718 | ||

| Elliott | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 | ||

| County | 100% limits | 80% limits | ||

| 1-2 Persons | 3 + Persons | 1-2 Persons | 3 + Persons | |

| Estill | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Fayette | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 |

| Fleming | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Floyd | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Franklin | $ 85,430 | $ 98,244 | $ 68,344 | $ 78,595 |

| Fulton | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Gallatin | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 |

| Garrard | $ 87,210 | $ 100,291 | $ 69,768 | $ 80,233 |

| Grant | $ 79,560 | $ 92,820 | $ 63,648 | $ 74,256 |

| Graves | $ 83,160 | $ 97,020 | $ 66,528 | $ 77,616 |

| Grayson | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Green | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Greenup | $ 83,040 | $ 96,880 | $ 66,432 | $ 77,504 |

| Hancock | $ 86,950 | $ 99,992 | $ 69,560 | $ 79,994 |

| Hardin | $ 86,750 | $ 99,762 | $ 69,400 | $ 79,810 |

| Harlan | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Harrison | $ 87,250 | $ 100,337 | $ 69,800 | $ 80,270 |

| Hart | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Henderson | $ 87,300 | $ 100,395 | $ 69,840 | $ 80,316 |

| Henry | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 |

| Hickman | $ 79,560 | $ 92,820 | $ 63,648 | $ 74,256 |

| Hopkins | $ 80,640 | $ 94,080 | $ 64,512 | $ 75,264 |

| Jackson | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Jefferson | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 |

| Jessamine | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 |

| Johnson | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Kenton | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 |

| Knott | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Knox | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Larue | $ 86,750 | $ 99,762 | $ 69,400 | $ 79,810 |

| Laurel | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Lawrence | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Lee | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Leslie | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Letcher | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Lewis | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Lincoln | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Livingston | $ 82,320 | $ 96,040 | $ 65,856 | $ 76,832 |

| Logan | $ 80,760 | $ 94,220 | $ 64,608 | $ 75,376 |

| Lyon | $ 87,310 | $ 100,406 | $ 69,848 | $ 80,325 |

| County | 100% limits | 80% limits | ||

| 1-2 Persons | 3 + Persons | 1-2 Persons | 3 + Persons | |

| McCracken | $ 87,130 | $ 100,199 | $ 69,704 | $ 80,159 |

| McCreary | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| McLean | $ 86,950 | $ 99,992 | $ 69,560 | $ 79,994 |

| Madison | $ 86,910 | $ 99,946 | $ 69,528 | $ 79,957 |

| Magoffin | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Marion | $ 80,760 | $ 94,220 | $ 64,608 | $ 75,376 |

| Marshall | $ 86,030 | $ 98,934 | $ 68,824 | $ 79,147 |

| Martin | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Mason | $ 85,920 | $ 100,240 | $ 68,736 | $ 80,192 |

| Meade | $ 85,790 | $ 98,658 | $ 68,632 | $ 78,926 |

| Menifee | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Mercer | $ 86,730 | $ 99,739 | $ 69,384 | $ 79,791 |

| Metcalfe | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Monroe | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Montgomery | $ 78,600 | $ 91,140 | $ 62,880 | $ 72,912 |

| Morgan | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Muhlenberg | $ 78,600 | $ 91,700 | $ 62,880 | $ 73,360 |

| Nelson | $ 85,170 | $ 97,945 | $ 68,136 | $ 78,356 |

| Nicholas | $ 78,600 | $ 90,860 | $ 62,880 | $ 72,688 |

| Ohio | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Oldham | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 |

| Owen | $ 78,600 | $ 91,700 | $ 62,880 | $ 73,360 |

| Owsley | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Pendleton | $ 101,100 | $ 116,265 | $ 80,880 | $ 93,012 |

| Perry | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Pike | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Powell | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Pulaski | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Robertson | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Rockcastle | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Rowan | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Russell | $ 78,600 | $ 90,860 | $ 62,880 | $ 72,688 |

| Scott | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 |

| Shelby | $ 92,700 | $ 106,605 | $ 74,160 | $ 85,284 |

| Simpson | $ 82,920 | $ 96,740 | $ 66,336 | $ 77,392 |

| Spencer | $ 89,700 | $ 103,155 | $ 71,760 | $ 82,524 |

| Taylor | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Todd | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Trigg | $ 87,590 | $ 100,728 | $ 70,072 | $ 80,582 |

| Trimble | $ 86,770 | $ 99,785 | $ 69,416 | $ 79,828 |

| County | 100% limits | 80% limits | ||

| 1-2 Persons | 3 + Persons | 1-2 Persons | 3 + Persons | |

| Union | $ 78,600 | $ 91,420 | $ 62,880 | $ 73,136 |

| Warren | $ 86,650 | $ 99,647 | $ 69,320 | $ 79,718 |

| Washington | $ 87,090 | $ 100,153 | $ 69,672 | $ 80,122 |

| Wayne | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Webster | $ 78,600 | $ 90,390 | $ 62,880 | $ 72,312 |

| Whitley | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Wolfe | $ 94,320 | $ 110,040 | $ 75,456 | $ 88,032 |

| Woodford | $ 89,300 | $ 102,695 | $ 71,440 | $ 82,156 |

You must be logged in to post a comment.